EOFY bestsellers

Signage to make your sale unmissable

Turn tax-time into deductions-time

Maximise deductions with custom stationery

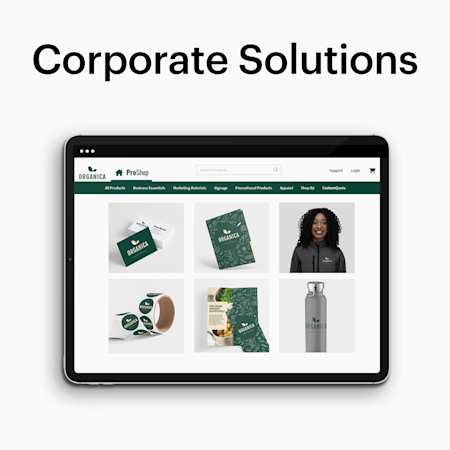

VistaPrint services

Ideas and advice

Set up your business for the end of the financial year

The end of the financial year is around the corner, and VistaPrint is here to help you and your business succeed. If your business is running an EOFY sale or event, we have a selection of marketing to get you prepped – from promotional signage supplies and flyers to stickers and tags that showcase your discounts. EOFY is also a good time to stock up on tax-deductible essentials that you use for your business every day – like branded stationery, business cards, postcards and more. With these tools, you’ll be ready for the year ahead and maximise your tax return.

Frequently Asked Questions

The end of the financial year marks the close of the fiscal year. It’s an important time of the year for small businesses as they take stock of their financials and submit a tax return.

The Australian financial year starts on 1 July and ends the next year on 30 June.

While the official end of the financial year is 30 June, a lot of businesses will run promotions or sales in the lead-up to this date to move last season's stock or inventory. Even if a stocktake or clearance sale isn’t necessary, a lot of businesses will capitalise on this busy time and participate in other promotional activities to attract customers.

Tax time can be stressful for small businesses. And aside from preparing your business for a busy season of sales, you’ll need to take stock of your financials and submit a tax return.

Here's a quick end of financial year checklist for small businesses:

- Prepare your financial records - In addition to lodging your tax return, your business might need to complete other tasks like a profit and loss statement or a stocktake.

- Find out what deductions are available - You can claim most of your business expenses as a tax deduction if they have contributed to your earnings. Here's a guide to what you can and can't claim.

- Review your performance and plan for the year ahead - This is the perfect time to assess your business performance over the past year and set your strategy for the new financial year ahead. It’s a good idea to review your budget and outcomes and your marketing plan frequently so you can adapt to changes quickly.